Thank You!

We want to express our everlasting gratitude to the community for trusting CVTC with your vote. Your confidence allows us to move forward with our referendum projects and achieve our goal of positively impacting the quality of life in our area through education.

Campus Improvement Projects

Construction

Transportation Education Center

Increase capacity for student enrollment to address the workforce shortage.

Expansion & Remodeling

Emergency Service Education Center

Meet current and future training requirements for emergency services.

Addition

Manufacturing Education Center

Update technical components and construct an automated fabrication lab.

Enhancement

Additional Campus Renovations and Expansions

Update current facilities to serve our growing student body.

Campus Improvement Projects

Construction

Transportation Education Center

Increase capacity for student enrollment to address the workforce shortage, gain efficiencies with a comprehensive facility to optimize shared resources, expand classrooms and labs for modern equipment, prepare for future technology with flexible learning labs, and upskill the current workforce.

Expansion & Remodeling

Emergency Service Education Center

Meet the training requirement needs of today and the future for law enforcement, criminal justice, fire medic, and paramedics, update simulation labs, create flexible tactical training spaces, renovate and expand the law enforcement firearms range, and update physical endurance testing and certification rooms.

Addition

Manufacturing Education Center

Keep up with the ever-evolving technology of the Manufacturing field, update the technical components necessary to train for the workforce, create space to safely train on machinery, upskill the current workforce for expanded and changing industry jobs.

Enhancement

Additional Campus Renovations and Expansions

Update current facilities to serve our growing student body, improve program offerings and spaces at regional campuses, create new spaces to ensure future success in modern industries, keep buildings safe and secure.

See How CVTC

Impacts Our Community.

The quality of life we all enjoy in the Chippewa Valley is directly dependent on the quality of education we provide here at CVTC.

Fulfilling Our Mission

CVTC delivers innovative, applied, and flexible education that supports a diverse community of learners, improves the lives of students, and adds value to our communities.

95%

Percentage of CVTC graduates employed within 6 months after graduation

145+

CVTC offers over 115 programs, 19 certificates, and 19 apprenticeships

84%

Percentage of graduates who find employment in Wisconsin after graduation

17,956

Total number of students CVTC served in last year

$59,742

Average starting salary of CVTC associate degree graduates

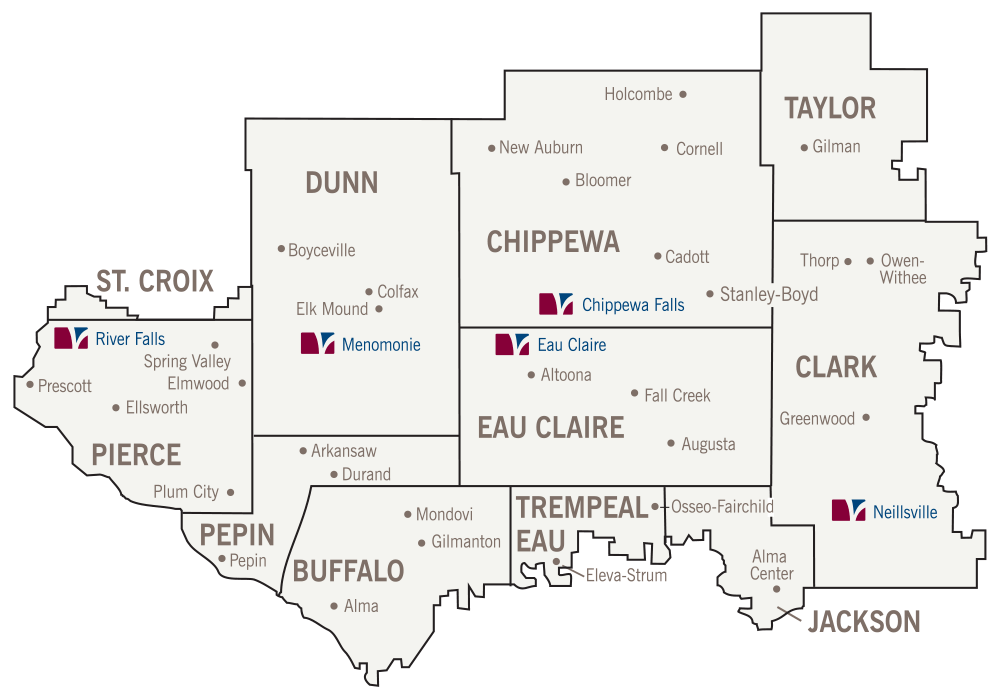

The CVTC District

Chippewa Valley Technical College is part of the Wisconsin Technical College System and serves an 11-county area. Campuses are located throughout the district including multiple locations in Eau Claire and in the Chippewa Falls, Menomonie, Neillsville and River Falls communities. The College is one of 16 WTCS colleges located throughout the state. CVTC has an appointed district board consisting of nine members who serve three-year, staggered terms.

Addressing Regional Workforce Needs

RESPOND

to the growing workforce labor shortage in the Chippewa Valley

ACCOMMODATE

evolving technology and industry expectations

IMPROVE

safety and security on campus and in our communities

PREPARE

for the future by making structural improvements and land investments